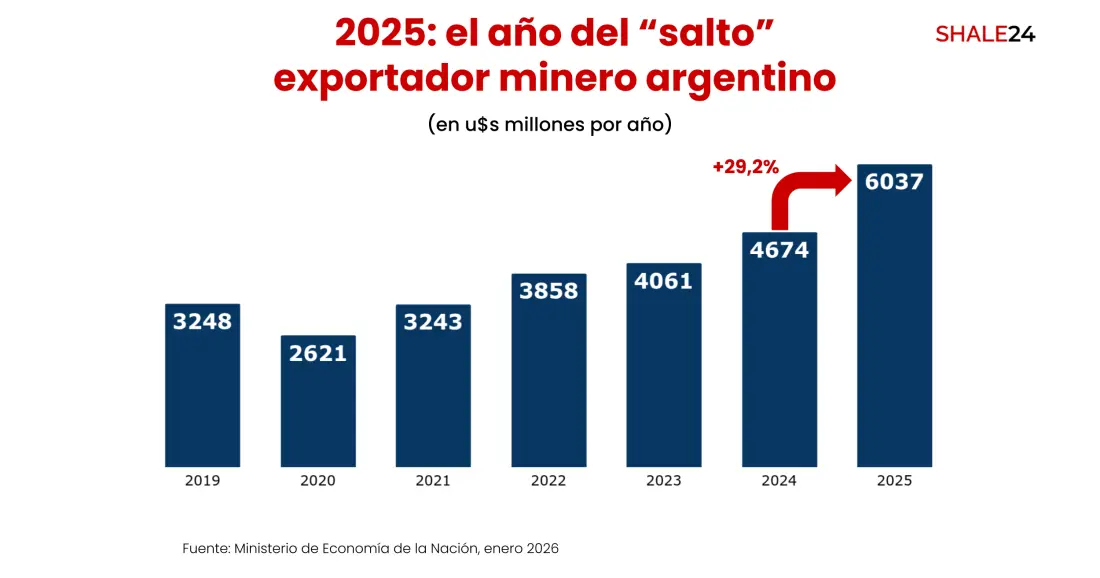

During the January–December 2025 period, Argentina’s mining exports totaled $6.037 billion, the highest value in the sector’s history, according to a recent statement from the Economy Ministry.

Compared with 2024, the figure represents a 29.2% increase. Over the past 12 months, exports of metallic minerals reached $4.948 billion, accounting for 82% of the sector’s total. Within that category, gold stood out, with exports of $4.078 billion, a record high.

Lithium exports, meanwhile, reached $905 million, also an all-time high, and accounted for 15% of the total. That performance reflects the start of production at four lithium projects between 2024 and 2025, raising the number of lithium mines in operation in the country to seven. Other minerals totaled $184 million, equivalent to 3%.

“These results show that the combination of favorable international prices, the startup of new projects and the consolidation of existing operations is allowing the sector to broaden its export base,” the ministry said.

Against this backdrop, and with investments encouraged by the Large Investment Incentive Regime (RIGI), the government expects continued exponential growth in the mining trade balance.

According to data from the Mining Secretariat, more than 130 projects are currently in early exploration and 73 in advanced exploration. If they enter production, mining exports could rise further in coming years, increasing Argentina’s share of the global mining landscape.

Of the projects already approved under the RIGI, three are mining-related.

- The most recently approved is Gualcamayo, in San Juan province. The core of the project is the development and exploitation of the Proyecto Carbonatos Profundos, through which Minas Argentinas S.A. plans to extend the life of its gold mine to produce about 120,000 ounces of gold per year for at least 17 years. The committed investment totals $665 million, with about $50 million earmarked for geological exploration.

- The other two projects are lithium developments. One is Rincón, in Salta, where Rio Tinto committed to invest $2.724 billion to deploy Direct Lithium Extraction (DLE) technology. The technique improves recovery rates and reduces water impact compared with traditional evaporation methods. The project is at an advanced operational stage, and its inclusion under the RIGI provides the stability needed to execute complex construction schedules in the high-altitude Puna region, reinforcing Salta’s position as a reliable and efficient mining hub for institutional investors.

- The other is the Hombre Muerto Oeste project, located in the Salar del Hombre Muerto in Catamarca province. Galán Lithium S.A. committed an initial investment of $217 million to produce high-purity lithium carbonate. The project stands out for the quality of its brines and low impurity levels, which reduce chemical processing costs and increase operating margins. Its inclusion under the RIGI is expected to accelerate construction and startup, with first exports projected for late 2026, providing a boost to Catamarca’s regional economy.

Nine additional mining projects remain under evaluation.

- The Vicuña Project is among the most promising and large-scale mining developments in Argentina’s recent history, emerging as a world-class copper hub in the Andes. It integrates the Josemaría and Filo del Sol deposits, located mainly in San Juan province, with extensions near the Chilean border. With resources placing it among the world’s 10 largest undeveloped copper deposits — more than 13 million metric tons of measured and indicated copper, 32 million ounces of gold and 659 million ounces of silver — Vicuña represents the largest greenfield copper discovery in the past 30 years. As a result, BHP and Lundin Mining submitted it to the special regime for Long-Term Strategic Export Projects (PEELP), committing $2 billion in investment.

- Also in San Juan, but led by Glencore, the Pachón Project stands as the single largest investment proposed under the RIGI, at $9.533 billion. It envisions the construction of a world-class copper mine with a projected life exceeding 25 years, positioning Argentina among the world’s top 10 copper producers.

- In Catamarca, the Agua Rica (MARA) project, also under Glencore’s umbrella, stands out for its innovative circular economy model. It integrates a high-grade copper and gold deposit with the existing infrastructure of the former Alumbrera mine, optimizing the environmental footprint and accelerating startup timelines through a $3.806 billion investment.

- Also in Catamarca, Rio Tinto is advancing the Sal de Vida project, with a committed investment of $818 million. The project features high-efficiency evaporation technologies to produce battery-grade lithium carbonate in line with international sustainability standards.

- In the same province, Posco is developing the Sal de Oro project with a $633 million investment, notable for integrating cutting-edge Korean technology in brine processing to ensure purity suitable for the electric vehicle market.

- Farther north, Ganfeng Lithium leads two strategic fronts: the expansion of Cauchari-Olaroz in Jujuy, which ranks among the country’s largest lithium operations by installed capacity, and the Mariana project in Salta, which was rejected for inclusion under the RIGI.

- In Salta, Abra Silver is advancing the Diablillos project. With a $500 million investment, it stands out as one of the region’s most significant undeveloped silver and gold deposits, offering a solid profitability profile due to its high-grade geology and optimized extraction methods.

- In San Juan, the alliance between Barrick and Shandong Gold to expand Veladero, with a $380 million investment, marks a milestone in operational continuity. The project extends the life of one of Argentina’s most emblematic gold mines through the optimization of its leach pads and resource management systems.

- At the heart of the Neuquén Basin, the Arenas de Cercanías project led by Minera del Mojotoro and Minera Orosmayo plans to invest $232 million to transform Vaca Muerta’s logistics. The project would supply locally produced, high-quality frac sand from Río Negro province, significantly reducing operating costs for unconventional oil and gas wells.