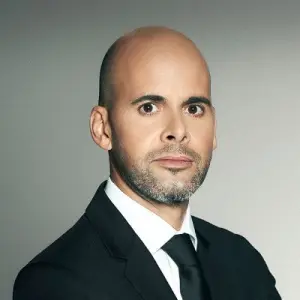

In a strategic move deepening its footprint in the heart of Vaca Muerta, Vista Energy, led by Miguel Galuccio, closed the acquisition of Equinor’s stakes in two premium shale oil blocks: 30% of Bandurria Sur and 50% of Bajo del Toro.

The net deal value, after the simultaneous reassignment of stakes to YPF (4.9% in Bandurria Sur and 15% in Bajo del Toro), is $712 million. With the transaction expected to close in the second quarter of 2026, Vista will hold 25.1% in Bandurria Sur and 35% in Bajo del Toro, making it one of the largest independent operators in high-productivity areas.

The technical metrics justify the move. Bandurria Sur, covering more than 56,464 acres, is one of the basin’s most mature and efficient fields: as of Sept. 30, 2025, it had 195 producing wells generating 81,285 barrels of oil equivalent per day (boe/d), including 67,634 barrels per day (bbl/d) of crude oil on a 100% basis. Proven reserves (P1) at year-end 2024 totaled 181 million boe, with an estimated 421 remaining drilling locations.

Bajo del Toro, at an earlier development stage, spans 38,744 acres, with 22 active wells producing 4,191 boe/d (mostly shale oil) and P1 reserves of 24 million boe, but with explosive growth potential from 396 additional identified drilling locations.

The net contribution of these assets to Vista is significant, adding roughly 21,869 boe/d (based on Q3 2025 production at post-deal stakes) and 54 million boe of additional proven reserves. Pro forma, this would lift Vista’s total production above 150,000 boe/d, compared with 126,800 boe/d reported in Q3 2025 (109,700 bbl/d of crude).

Productivity gains drive the business

Vista already posts some of the highest individual well productivity in the basin, with Bajada del Palo Oeste and La Amarga Chica wells averaging leading performance, low lifting costs (around $4.7/boe for the acquired assets), and adjusted EBITDA margins near 65%.

The deal is not just about volume. It strengthens Vista’s well inventory, which already exceeds 1,653 identified locations in Vaca Muerta, roughly 1,320 of them ready to drill.

The Equinor assets add 244 net locations in core areas, extending the company’s low-cycle, high-margin growth push. Vista maintains a strong focus on operational efficiency, including multilateral drilling, fracture optimization, and continuous cost reduction, enabling it to compete at export parity even under moderate price scenarios.

The macro context reinforces the strategy. Vaca Muerta now approaches 600,000 bbl/d of shale oil (67–70% of Argentina’s total crude output), with Vista emerging as the leading independent producer and private exporter, selling over 60% of its oil at international prices. The transaction strengthens Vista’s alliance with YPF, operator of both blocks, and leverages midstream infrastructure synergies, including transport rights and offtake agreements supporting its export ambitions.

Since entering Vaca Muerta, Vista has invested more than $6.5 billion. Its 2026–2028 strategic plan includes an additional $4.5 billion to scale production to 180,000 boe/d by 2028 and 200,000 boe/d by 2030, with projected annual free cash flow of $1.5 billion assuming Brent at $65–70 per barrel.