The global precious metals market is witnessing an unprecedented phenomenon that has positioned silver not only as a store of value but also as a critical fuel for the modern energy transition.

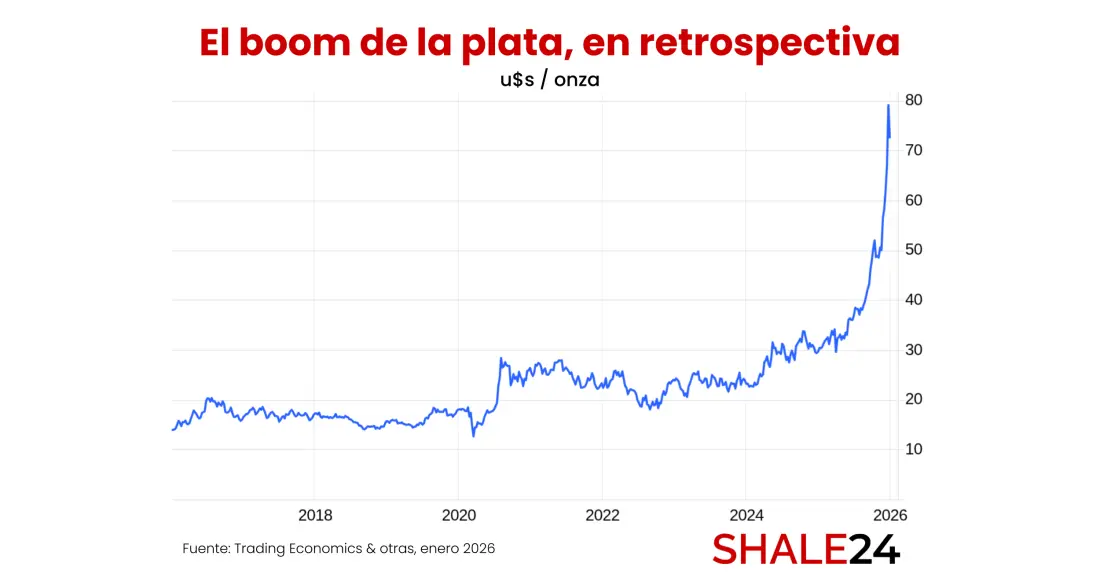

At the start of 2026, silver prices have been breaking through historic ceilings, far surpassing records from previous decades and entering a phase of so-called price discovery that has Wall Street analysts and major industrial powers on edge.

After spending years confined to a technical resistance range of $22 to $25 an ounce, silver broke the psychological $50 barrier in late 2025 and has continued its steep climb, reaching peaks that defy any prior historical benchmark.

This bullish rally, which has seen the metal surge nearly 150% over the past year, is the result of a convergence of factors: a structural supply deficit now in its fifth consecutive year and rapidly growing demand from the photovoltaic industry and high-end electronics.

This is not a market whim, but a largely technical escalation. Silver has long ceased to be the “poor cousin of gold” and has instead become a core strategic asset. It has been designated a critical mineral by the world’s leading economies due to its unmatched electrical conductivity, which is essential for solar panels and electric vehicle components.

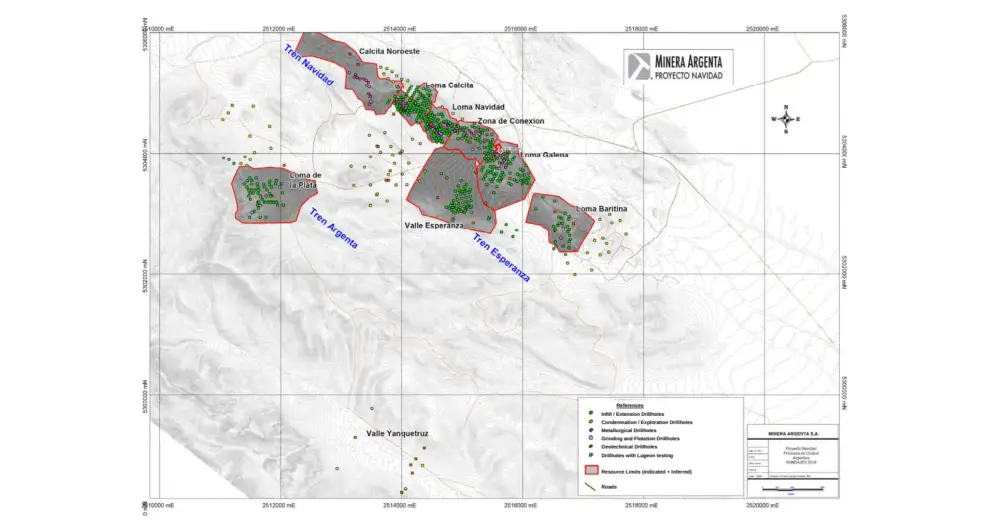

This reflects a physical reality in which today’s buying pressure directly benefits countries with large, proven reserves. In a context of sky-high prices, all eyes are converging on a strategic point on the map: Chubut province in Argentina’s Patagonia region, where Pan American Silver’s long-dormant giant, the Navidad project, has been sitting for years.

A sleeping giant in the “land of silver”

As of early 2026, the Navidad project remains the largest undeveloped silver deposit on the planet, with estimated reserves exceeding 600 million ounces of silver. If developed, Argentina would not only climb the global rankings of silver producers, where it currently stands 10th, but could challenge for global leadership, turning Patagonia into a new hub for high-purity silver mining.

The economic impact of bringing a giant like Navidad into production would be massive. Technical and consulting reports suggest annual output could average 16 million to 20 million ounces of silver, representing a significant boost to national exports and an influx of real investment into a region in need of development and infrastructure.

Navidad owes its name to the fact that the first exploration results were obtained on Dec. 25. Pan American Silver had targeted annual production of 7.5 million ounces of silver and pledged the creation of about 2,800 jobs, including 800 direct positions.

In Chubut province, open-pit metal mining remains prohibited. In December 2021, the provincial government attempted to establish a special zoning framework through the Sustainable Metal Mining Industrial Development Law, which would have allowed mining in the departments of Telsen and Gastre, in the central plateau where the Navidad project is located.

After five days of protests that culminated in fires at public buildings, the province reversed course. The same Legislature that had approved the zoning measure repealed it unanimously. This episode reaffirmed the validity of Law 5001 and made clear that any attempt to move forward requires a level of social consensus that, so far, remains the project’s greatest challenge.

This complex legal and social framework is what continues to keep Navidad among the world’s most valuable but “blocked” reserves, at a time when silver has become one of the most sought-after strategic assets globally. For technical analysts closely tracking Pan American Silver’s prospects in the region, the evolution of this legal environment is as critical as the price of the metal itself.

The combination of record international prices and a world-class reserve like Pan American Silver’s creates a potential scenario of exceptional profitability that could attract billions of dollars in new investment.

Main local silver projects

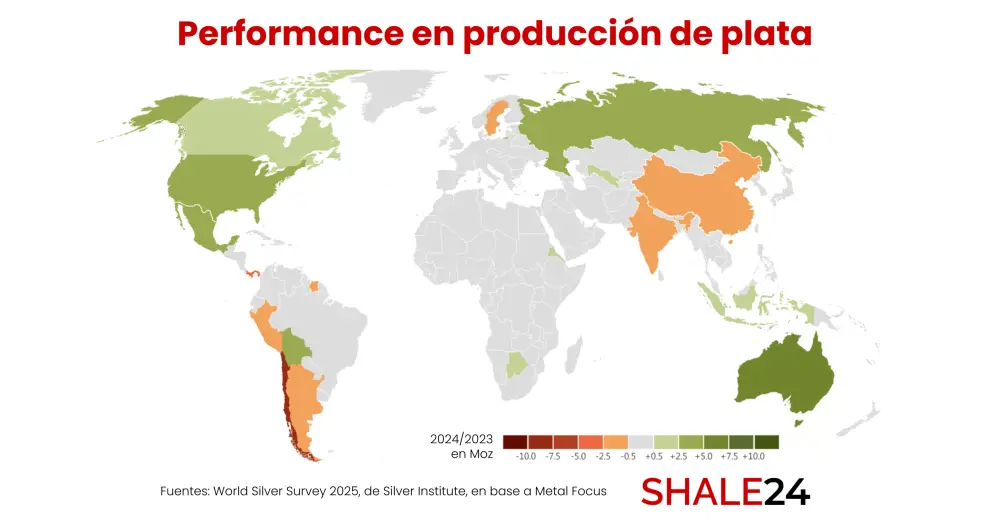

Five of the world’s 10 largest silver-producing countries are in Latin America. Argentina, however, ranks last within that top 10, trailing Mexico, Peru, Bolivia and Chile, where mining is more developed and contributes a larger share to gross domestic product.

Argentina has 13 silver mines in production, about half of them located in Patagonia, mainly in Santa Cruz province. A significant number of other projects are located in the country’s northwest, particularly in Jujuy province.

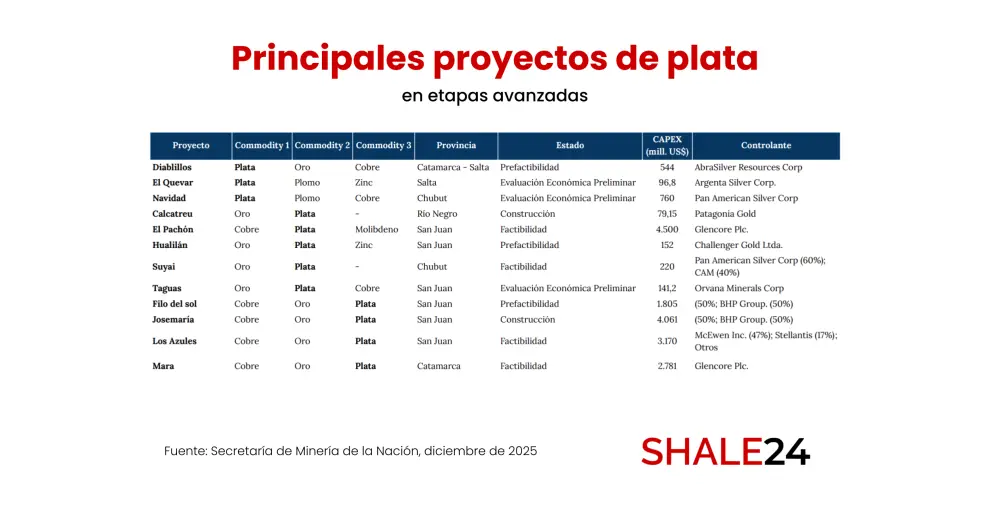

In addition, there are 12 projects at advanced stages that are expected to produce silver in the near future. Of these, four are primarily gold projects and another four are copper projects. Most are located in the Cuyo region, mainly in San Juan province, with the remainder in Patagonia.

According to estimates from Argentina’s Secretariat of Mining, silver resources in the country total 3,837 million ounces, while reserves stand at 492.7 million ounces. There are still areas of Argentina that remain unexplored, which could further increase these estimates over the medium term.

Even within producing mining projects, exploration is ongoing, with continuous efforts to better quantify available resources and reserves.

The Secretariat of Mining projects that Argentina’s silver exports will peak around 2032 at an estimated value of $866 million, following a period of decline expected to bottom out in 2028 at about $441 million. This future recovery is linked to new projects coming online, including the Diablillos project in the provinces of Catamarca and Salta, as well as a group of projects where silver is produced as a byproduct of other minerals, mainly copper and gold.