Argentina’s Economy Ministry introduced a key change to the composition of the Project Evaluation Committee under the Large Investment Incentives Regime, or RIGI, through Resolution 1725/2025, published in the Official Gazette.

The update aims to align project evaluations with priorities for attracting foreign capital, as the regime continues to expand.

The main change is the addition of the head of the Ministry of Foreign Affairs, International Trade and Worship, commonly known as the Foreign Ministry, as a full member of the committee.

The measure responds to the growing inflow of foreign investment drawn by the RIGI and seeks to strengthen links with international trade and the promotion of large-scale projects.

With the update, the RIGI Project Evaluation Committee is now composed as follows, reflecting the current officeholders as of January 2026:

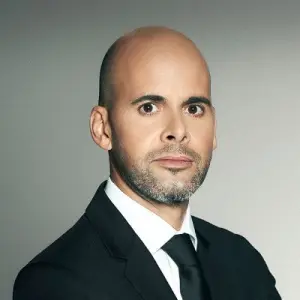

- Minister of Foreign Affairs, International Trade and Worship: Pablo Quirno, who took office in October 2025 after serving as finance secretary.

- Executive Deputy Chief of Cabinet, Cabinet Office: José Luis Daza, appointed in December 2025 as part of adjustments to the team led by Cabinet Chief Manuel Adorni.

- Executive Director of the National Ports and Navigation Agency: Iñaki Miguel Arreseygor, in the role since January 2025, with experience in port management and strategic tenders.

- Secretary of Energy and Mining Coordination: Daniel González, former CEO of state oil company YPF, appointed in September 2024 and a key figure in promoting extensions to the RIGI.

- Secretary of Production Coordination: Pablo Agustín Lavigne, who assumed office in December 2024, with a focus on industry and trade.

- Secretary of Finance: Alejandro Lew, appointed in November 2025 to replace Quirno.

- Secretary of the Treasury: Carlos Guberman, in office since the start of the current administration and responsible for fiscal policy.

- Secretary of Legal and Administrative Affairs: José Ignacio García Hamilton, in the post since December 2023.

The committee also previously included the Secretary of Infrastructure, Martín Maccarone, who served until December 2025. That position is currently in transition, with a successor yet to be appointed.

Originally created by Resolution 814/2024 and later adjusted several times, including through Resolution 521/2025, the committee is responsible for the final evaluation of applications to join the RIGI and of investment plans submitted by Single Project Vehicles. Its role is to issue a final report recommending approval or rejection, based on technical assessments by the relevant government areas.

Incentives and requirements

The RIGI, established under Law 27,742, known as the Bases Law, offers a framework of legal, tax and foreign-exchange stability for 30 years for investments exceeding $200 million in strategic sectors such as mining, energy, infrastructure, forestry and industry.

Technical requirements for participation include the creation of a Single Project Vehicle, submission of a detailed investment plan with timelines, economic and export impact, and compliance with environmental and labor standards.

Key incentives include exemptions from import duties, accelerated depreciation of assets, free availability of foreign currency from exports, up to 100% after certain periods, and tax stability provisions that prevent tax increases.

Disputes are to be resolved through international arbitration, including under the Permanent Court of Arbitration, the International Chamber of Commerce or the International Centre for Settlement of Investment Disputes, prioritizing investor protection. The original application deadline expires in July 2027, though an annual extension is under consideration given strong demand.

Approved and pending investments

In 2025, the first full year of the RIGI’s operation, progress was significant. Nine projects were approved, representing total investment commitments of $25 billion, equivalent to about 3.5% of estimated GDP.

These projects are concentrated mainly in mining, including lithium and copper, energy, such as solar and wind parks, pipelines and liquefied natural gas, and the steel industry, with impacts in provinces including Mendoza, Salta, San Juan, and Buenos Aires. Notable initiatives include the El Quemado Solar Park, developed by YPF Luz with an investment of $1.2 billion and already in operation; the Rincón lithium project, with $2.724 billion in investment; and the Argentina LNG project, valued at $6 billion, which is expected to boost hydrocarbon exports and could double oil export revenues within two years.

At the same time, 19 projects remain pending approval, with potential investments totaling $37.6 billion, or 5.3% of GDP. Most of these, about 89%, are in mining, with a focus on copper and lithium, while 10% correspond to energy. The most significant include El Pachón, led by Glencore with $9.533 billion in San Juan; Agua Rica–MARA, with $3.806 billion in Catamarca; and Los Azules, with $2.672 billion in San Juan. One project was rejected, the Mariana lithium project in Salta, because it had begun before the regime came into force.

Taken together, approved and pending projects total $62.6 billion, pointing to a potential export surge in key sectors. The expanded committee structure is intended to optimize the attraction of foreign capital by aligning administrative evaluation with economic diplomacy.

The change took effect immediately and does not alter the committee’s core functions, which remain under the authority of the RIGI’s implementing agency within the Economy Ministry.

With a positive annual balance, the regime is consolidating its role as a driver of growth, although debates persist over its environmental and fiscal impacts.