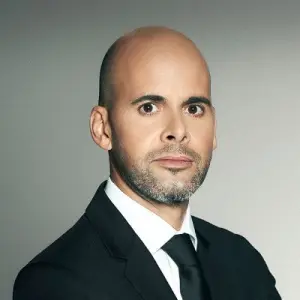

In an exclusive interview with Shale24, YPF President and CEO Horacio Marín confirmed that JPMorgan has been selected as the lead bank to structure and place the project finance for Phase 2 of the Argentina LNG Project, the large-scale liquefaction development the Argentine company is advancing with Eni and, if confirmed in the coming weeks, with XRG, the international investment arm of ADNOC.

It is worth recalling that the framework agreement signed weeks ago between YPF, Eni and XRG was strictly nonbinding : a framework agreement that only set the basis for exploring the Emirati company’s participation, without any legal or financial commitments.

However, in an interview with Shale24, Marín pointed to the decisive step ahead: “We are very far along. I think that in the next few weeks, still in December —January at the latest— we will be able to sign the binding agreement with ADNOC.” That definitive contract is what formally commits the parties, sets equity stakes and, above all, enables the formal launch of the debt process.

JPMorgan’s selection is no coincidence. The U.S. bank is one of the world’s leading players in LNG project financing, with a track record that includes landmark transactions such as Mozambique LNG, Golden Pass LNG, Plaquemines LNG, Corpus Christi Stage 3 and Rio Grande LNG, among others.

The financing package —estimated at $14 billion to $16 billion of debt, or 70% to 80% of total capex— will be activated at the beginning of 2026 once the binding agreement is signed. “YPF will use JPMorgan to seek project financing in early 2026 for the 12-million-ton phase,” Marín said.

Experience in LNG operations, the key to securing funding

JPMorgan’s selection is no coincidence. The U.S. bank is one of the world leaders in LNG project finance, with experience structuring major deals such as Mozambique LNG, Golden Pass LNG, Plaquemines LNG, Corpus Christi Stage 3 and Rio Grande LNG.

Marín laid out the timeline in clear terms:

- Binding agreement with ADNOC → December 2025 (January 2026 at the latest)

- Launch of the project finance process with JPMorgan → first quarter 2026

- FID (final investment decision) → mid-2026

- First export → 2030 or 2031

With ADNOC on board —something Marín all but confirmed— the executive believes the project gains not only financial strength but also privileged access to the Asian market, where the Emirati company is a dominant player. YPF’s ambitious goal is to reach 18 MTPA in the phases under its control, which would place Argentina among the world’s ten largest LNG exporters by the end of the next decade.

As Vaca Muerta posts record production levels, JPMorgan’s arrival as the financing structurer marks the Argentina LNG Project’s definitive entry into the select group of major global LNG developments already on the radar of leading infrastructure funds, export credit agencies and commercial banks.

In this context, Shell’s exit from Phase 2 of the project —announced this week and confirmed by the Anglo-Dutch company— represents a relative setback, but in Marín’s view does not alter the overall momentum. The supermajor, which had signed a development agreement with YPF just a year ago to lead that 12-MTPA segment, withdrew citing “a significant change in the scope of the project” that cut its size in half to 6 MTPA.

Marín downplayed the impact, stressing that the priority phase with Eni and XRG-ADNOC remains intact and that YPF is already seeking a new partner to fill the gap, keeping its overall target of 18 MTPA under Argentine control.