During 2025, Argentina’s energy trade balance posted a surplus of $7.815 billion, according to official data from the National Institute of Statistics and Census (INDEC) and the Energy Secretariat.

The figure marks the largest annual surplus ever recorded for the sector since systematic data became available, at least dating back to 1992. It clearly exceeds positive balances from previous years, including 2024 and the peak export periods of the early 2000s.

The key components behind the performance were:

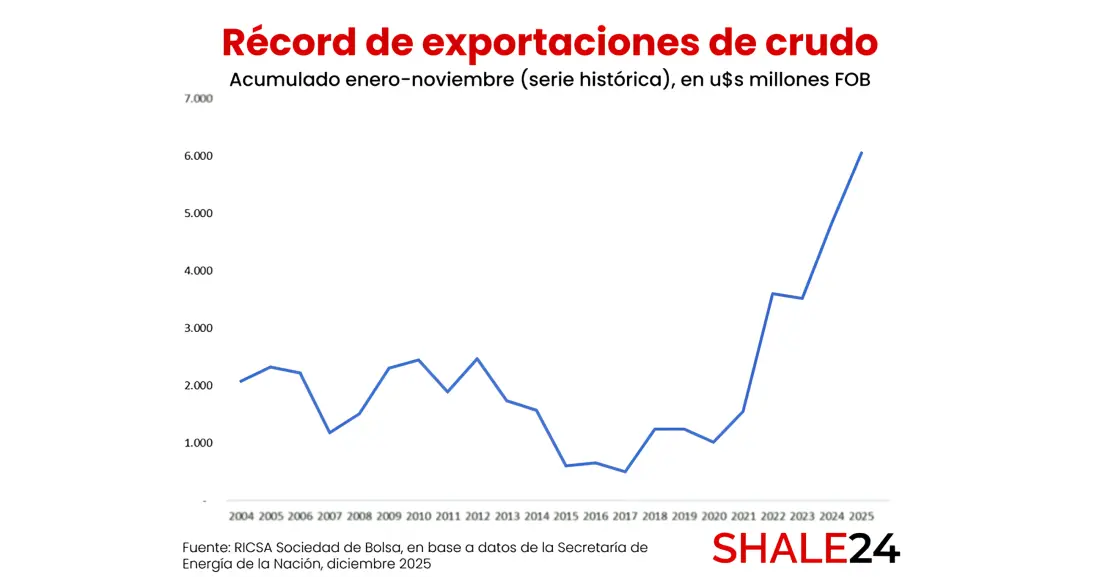

- Record exports: Overseas sales of fuels and energy products totaled $11.086 billion, up 12.8% year over year. This represents an all-time high for the category, driven mainly by crude oil and refined products linked to the development of unconventional resources.

- Lower imports: Energy imports fell to $3.271 billion, an 18% decline from the previous year. The contraction reflects greater domestic self-sufficiency and reduced reliance on external supplies, particularly of natural gas and derivatives during seasonal demand peaks.

- Contribution to the overall trade balance: The energy surplus accounted for about 69% of Argentina’s total trade surplus in 2025, which closed at $11.286 billion. This contribution cemented the sector as one of the country’s main sources of foreign currency amid a broader macroeconomic recovery.

Vaca Muerta, the master key

The central driver of this transformation has been the Vaca Muerta formation in the Neuquén Basin. In 2025, oil output reached historic levels:

- In December, production hit a record 868,712 barrels per day, according to Energy Secretariat data, surpassing the previous peak in October by 1.17% and confirming a sustained upward trend.

- The annual average stood at around 800,000 bpd, still below the all-time record of 846,955 bpd set in 1998.

- Vaca Muerta accounted for roughly 67% of national output in several months, supplying about two out of every three barrels produced in the country.

- At the provincial level, Neuquén led with 601,273 bpd in December, more than 69% of national production, followed by Chubut with 120,431 bpd and Río Negro with 23,673 bpd, up 8.19% month over month.

Anatomy of the expansion

Growth was underpinned by technological advances — longer horizontal laterals, optimized drilling and hydraulic fracturing — and by a more stable regulatory framework that attracted private investment from domestic and international companies. The result was an increase in exportable volumes even as international oil prices remained moderate or declined compared with earlier periods.

The energy surplus strengthened international reserves, eased pressure on the foreign exchange market and reduced Argentina’s longstanding vulnerability to external shocks in other sectors, such as agriculture.

It also helped curb spending on energy subsidies by making domestic supply cheaper than imported alternatives.

Looking ahead to 2026, both official and private forecasts expect the sector to retain a leading role:

- Continued investment in takeaway infrastructure, including oil and gas pipelines.

- Potential expansion into liquefied natural gas exports, drawing interest from global players.

- Growing potential for Argentina to challenge for a leading position in regional crude production.