Amid volatility in the global liquefied natural gas (LNG) market, the Argentine Embassy in Japan organized a webinar that brought together more than 60 representatives from Japan’s energy sector, public agencies and financial institutions. The event, titled “Argentina–Japan LNG Investments,” served as a platform for YPF to present opportunities linked to the Argentina LNG megaproject, positioning Vaca Muerta as a strategic supplier for Japan’s growing demand.

The webinar, held Dec. 12, marked a “milestone” in bilateral cooperation. Participants included Argentina’s ambassador to Japan, Eduardo Tempone; Ariel Gordon, LNG public affairs manager at YPF; Yusuke Nishizawa, executive director of the Japan External Trade Organization (JETRO); Gustavo Di Luzio, LNG executive manager at YPF; Santiago Molteni, YPF project finance manager; and Martín Berardo.

Japan, a giant LNG importer

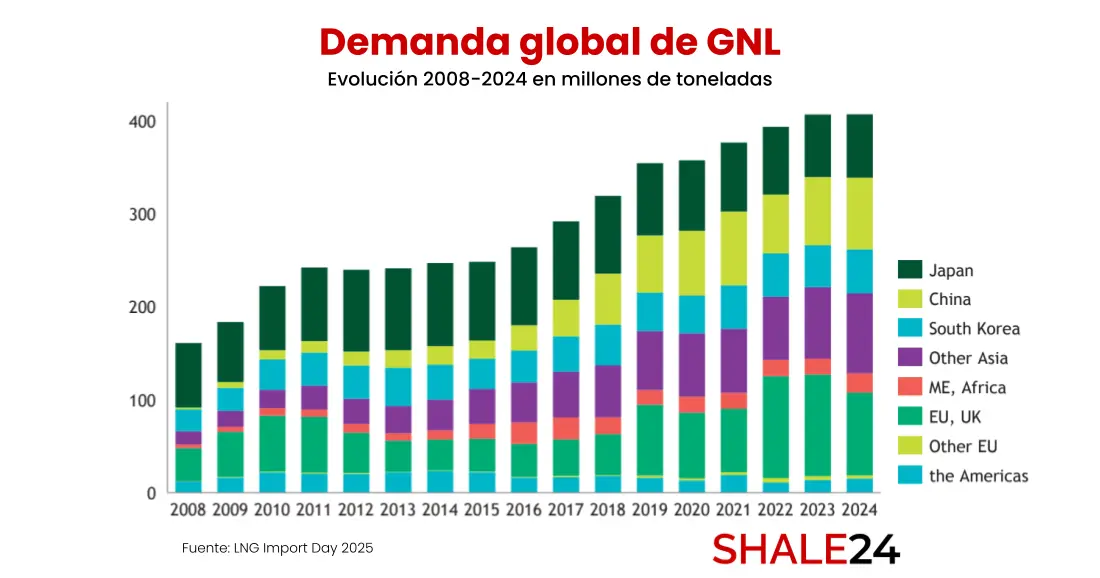

Japan is the world’s second-largest LNG importer, behind China, and its energy mix continues to show a high dependence on the fuel. In the first three months of 2025, Japan imported 17.67 million metric tons of LNG, 13% more than China over the same period. In October 2025, LNG imports rose 10.5% year over year, driven by pre-winter restocking, at a cost of $3.04 billion.

The Asian country is seeking to diversify its LNG supply sources as part of its energy security strategy. Australia remains its main supplier, accounting for a very significant share of total imports—around 40%. Geographic proximity and large production volumes have helped cement that relationship. Historically, Russia was also a key supplier through projects such as Sakhalin-2, although the security and continuity of those imports have been debated at the government level following Russia’s invasion of Ukraine. Qatar and Oman, among the world’s largest LNG exporters, are considered stable suppliers for Japan. Malaysia is another important source, relatively close to Tokyo.

In recent years, the U.S. has become one of the world’s largest LNG exporters and has rapidly increased its share of the Japanese market. Morgan Stanley projects Japanese LNG imports at 78 million metric tons by 2030, driven by artificial intelligence-related demand growth and gas-fired power generation.

Inside Japan’s energy market

Japan imports LNG through several companies that can broadly be grouped into two categories. The first includes major power generators, which require LNG for nationwide electricity and gas supply. The largest and most influential player in this segment is JERA Inc., a joint venture between Tokyo Electric Power Company Holdings (TEPCO) and Chubu Electric Power Co.

JERA is Japan’s largest LNG buyer and one of the largest globally. Many long-term supply agreements with exporters such as Oman and the U.S. are signed and managed through JERA. Tokyo Gas, Japan’s main gas utility, also holds major LNG supply contracts. Kyushu Electric Power Co. is another regional utility that secures its own LNG volumes. This group also includes upstream companies such as Inpex Corp., Japan’s largest oil and gas exploration and production company, which signs import agreements directly to secure supply.

The second category consists of Japan’s large trading houses, known as sōgō shōsha. These general trading companies play a crucial role as intermediaries, facilitating large-scale deals and diversifying risk. Mitsui & Co. is one of the largest and most influential, involved in negotiating and managing major LNG contracts, like those with Oman. Itochu Corp. is another key player in LNG deal-making.

Outlook and challenges

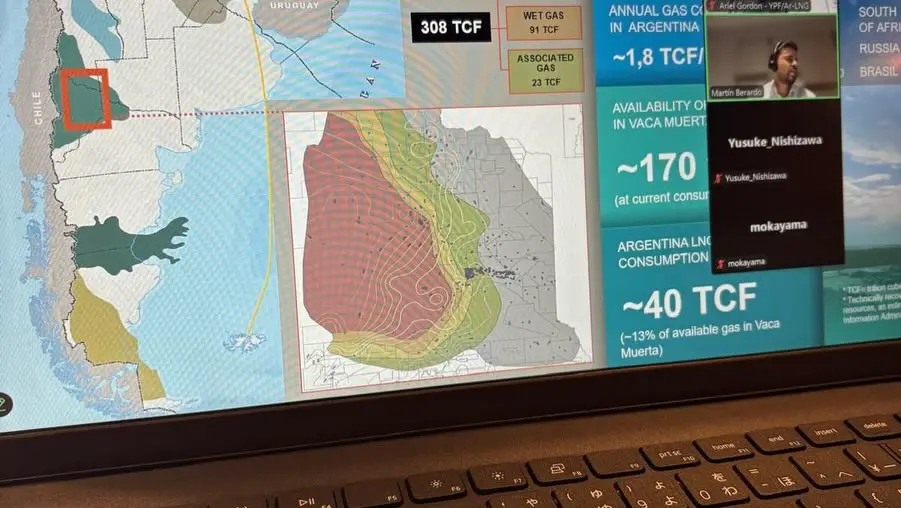

For Argentina LNG, Japan represents a significant opportunity. Vaca Muerta holds the world’s second-largest shale gas reserves, giving Argentina a competitive advantage in terms of volume to supply large-scale contracts like those sought by Japan. Operators in the Neuquén Basin have been demonstrating growing technical and operational capabilities to develop these unconventional resources more efficiently, boosting confidence among international traders. Japan is closely monitoring these developments.

Analysts, however, point to certain risks, including high Pacific shipping costs and intense competition from other suppliers such as the U.S. and Qatar. If Argentina fails to move quickly and new suppliers enter the market with greater capacity, LNG from Vaca Muerta could be sidelined or become less competitive.