The year 2025 marks the most active period in Vaca Muerta’s history, exceeding last year’s hydraulic fracturing activity.

In recent statements, Luciano Fucello, country manager for consulting firm NCS Multistage, estimated: “We have already accumulated 22,000 stages so far this year. Last year’s monthly average was 1,450 stages, and this year activity has remained above every month of 2024. The peak was in May, when 2,600 fracture stages were completed. By November, we were already 24% ahead of all of last year’s activity.”

But the jump isn’t just quantitative. This year the basin saw a shift in operational strategy: it’s no longer just about “more fractures” but a growing concentration of activity in core assets and an increase in intensity per well. Horizontal branch lengths have risen from an average of 2,000 meters to frequently exceed 3,500 meters, requiring more stages per well to remain productive.

Companies like YPF and Vista are implementing fractures in two wells simultaneously (Dual Frac), which explains why stage counts spike in certain months without doubling the number of physical fracturing sets. Both companies operate in areas now considered the lowest operational risk: in 2025, La Amarga Chica (YPF) and Bajada del Palo Oeste (Vista) strengthened their positions as the assets with the most consolidated learning curves and greatest resilience to fluctuations in international prices.

By the end of 2025, YPF accounted for more than 50% of all fractures nationwide. During peak months, the company completed as many fracture stages as the next six companies combined.

The corporate landscape, however, shows notable shifts with the steady rise of Vista Energy, which has consolidated itself as the second-most dynamic player, maintaining a constant industrial pace that outpaces international majors like Shell and Chevron. Led by Miguel Galuccio, Vista aims to demonstrate operational agility and scale to compete at historic volumes.

Other key players such as Tecpetrol and Pampa Energía have leveraged their niches, especially in gas, closely aligned with demand windows under the Plan Gas.Ar, concentrating their fractures in months leading up to the austral winter.

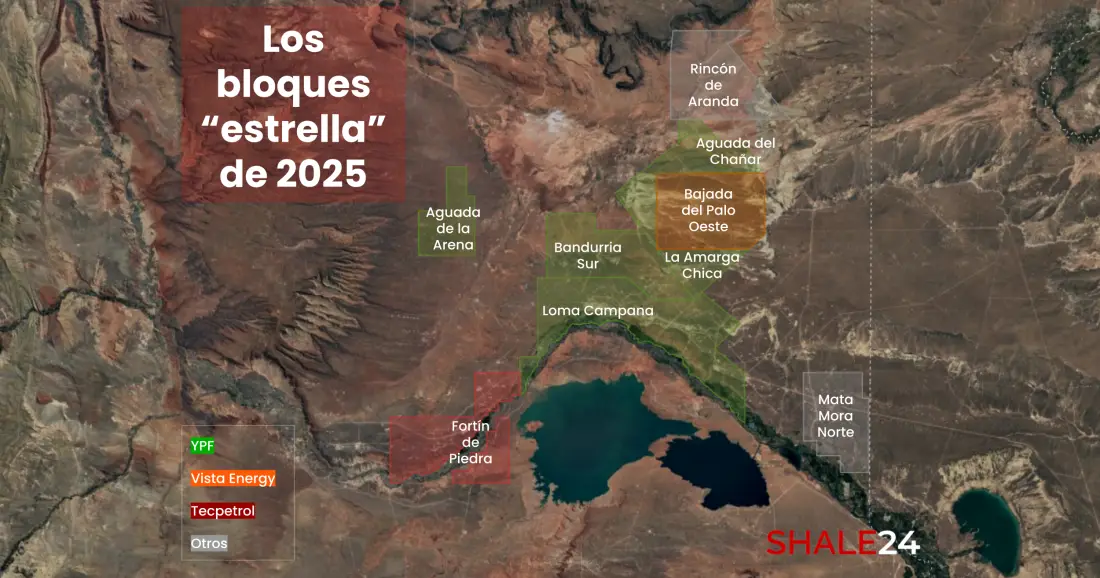

The “star” fields of 2025

This year, activity shifted from an initial exploratory phase to a new phase of massive development in specific fields now acting as true energy hubs:

- Loma Campana, La Amarga Chica, and Bandurria Sur: This “golden triangle” operated by YPF continued to lead the rankings in 2025. In April alone, 931 stages were completed, representing 42% of the monthly total. These blocks were the main contributors to the production record of over 547,000 barrels per day in August 2025.

- Bajada del Palo Oeste: Vista’s flagship field remained the second engine of fractures. The company achieved a 184% profit increase thanks to efficiency in this block, with peaks of up to 426 fractures in high-activity months like August. It was the surprise of the year and emerged as the fastest-growing 100% privately operated block.

- Fortín de Piedra (Tecpetrol): Continues as the formation’s main gas field, maintaining a steady fracturing pace to supply domestic demand and regional exports.

- Aguada del Chañar: Emerged strongly in late 2024/2025. Operated jointly by YPF and CGC, it became an emerging hotspot, recently setting a record of 22 stages completed in less than 24 hours.

- Aguada de la Arena (YPF): Received new unconventional concessions in March 2025, becoming a strategic focus for the company’s gas production growth.

- Rincón de Aranda: Consolidated as a “revelation” oil field in 2025. Pampa Energía executed intensive plans, including 96 fractures in a single month with a Halliburton set, as part of its US$700 million annual investment.

- Mata Mora Norte (Phoenix Global Resources / Geopark): Also stood out with activity peaks averaging 96 fractures per month during key periods in the first half of the year.

Warnings for 2026

- Evacuation limits: Fracturing activity is growing faster than the capacity of pipelines.

- High dependence on services: The market is at its technical capacity; any additional increase in 2026 will require importing new high-power fracturing sets (2,500+ HP).

- High sand costs: In 2024, 4 million tons of fracturing sand were required. The trend for 2026 is to shift to so-called “local sands” from Neuquén, Río Negro, La Pampa, and Mendoza to reduce logistics costs, which currently account for 15-20% of the total well cost.