In 2025, Vaca Muerta cemented its position as the undisputed hub of hydrocarbon production in Argentina. According to the latest data from the Energy Secretariat, the Neuquén Basin now accounts for 70% of the country’s oil and gas output.

This milestone positions the province of Neuquén as the epicenter of Argentina’s new energy cycle for the remainder of the decade. The jump in output reflects a surge in operational intensity, with drilling and hydraulic fracturing levels surpassing historical records from the past 30 years, projecting an unprecedented level of production predictability by year-end.

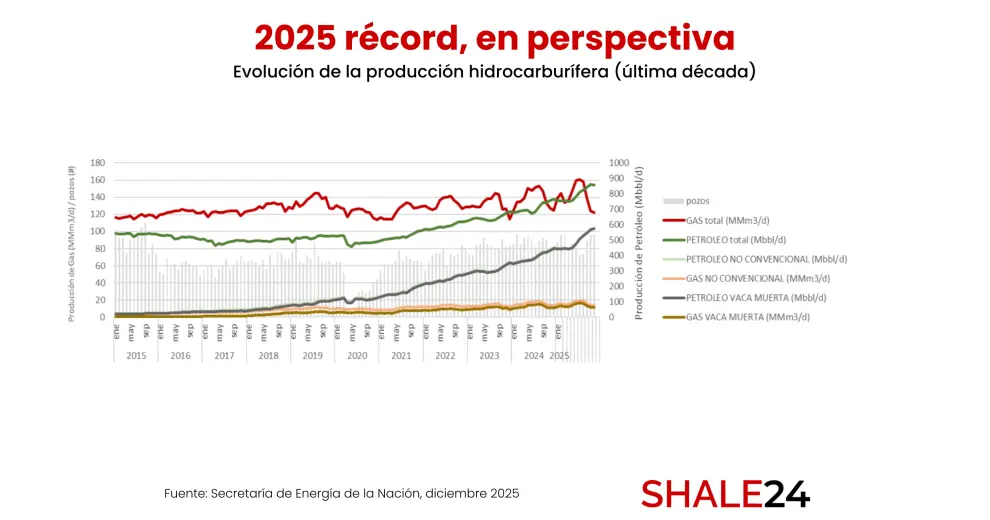

Oil and gas production reached 857,700 barrels per day and 122.3 million cubic meters of gas per day in November, driven largely by the strength of unconventional operations. Shale oil and shale gas have moved from being a future promise to the sector’s current engine, more than offsetting the natural decline of conventional basins.

Higher Productivity Per Well

Argentina’s hydrocarbon sector is now at the peak of a learning and technical execution curve that has transformed the Neuquén subsoil into an increasingly efficient extraction platform. Viewed over time, Vaca Muerta shows not only volume growth but a geometric acceleration in productivity per well.

Between 2020 and 2025, unconventional oil production rose from accounting for just a quarter of the national total to dominating 70% of the country’s supply, a transformation that required capital-intensive investments now reflected in a cumulative energy trade surplus of $6.911 billion as of November. This growth is not linear; it results from a drastic reduction in drilling times and an increase in the length of well laterals, which now average 3,000 meters, optimizing the cost of extraction per barrel.

To understand the scale of the phenomenon, consider recent historical data: in 2021, Argentina’s total oil production was around 520,000 barrels per day, of which shale oil contributed only about 160,000 barrels. By November 2025, total production reached 857,700 barrels daily, with 579,800 barrels coming exclusively from unconventional sources. This represents a compound annual growth rate (CAGR) above 25% in the shale segment.

On the natural gas front, the change has been equally disruptive. The country moved from structural dependence on LNG imports and Bolivian gas to producing 122.3 million cubic meters per day, with the Neuquén Basin alone providing over 76 million cubic meters daily. This production supports steady exports to neighboring countries and lays the groundwork for infrastructure capable of serving the global market.

Greater Operational Efficiency and Technical Muscle

Operational acceleration is the clearest indicator of the new energy cycle led by Neuquén. Over the past year, hydraulic fracturing intensity peaked at 1,600 stages per month, 30% higher than 2023 levels. This enhanced technical capacity enabled crude oil production to grow 14.5% year-over-year in November 2025.

These results have solidified Vaca Muerta as the country’s energy heart, with projected net export earnings from oil and gas approaching $11 billion by the end of 2025.

The trend is reshaping Argentina’s energy trade balance. By October 2025, the country had already accumulated a $6.068 billion surplus, surpassing total performance in 2024. Year-end projections are even more ambitious, with a positive balance potentially reaching $7.2 billion, injecting crucial liquidity into the national economy.

The dynamism at the heart of the Neuquén Basin is reflected in an operational efficiency that international markets are watching more closely than ever. Leading companies such as YPF set records this year with 190,000 barrels per day from Vaca Muerta operations alone, accelerating strategic plans like the '4x4' program to boost exports.

Infrastructure is keeping pace with growth. Key projects include the Vaca Muerta Sur pipeline (VMOS) and expansions at Argentina LNG plants, aimed at delivering Argentine hydrocarbons to global markets.

In this context, the Incentive Regime for Large Investments (RIGI) has started attracting fresh capital, ensuring that drilling intensity remains high through 2026, with government targets for energy exports set at $17 billion for the next year.