Argentina’s energy landscape is undergoing an unprecedented structural transformation.

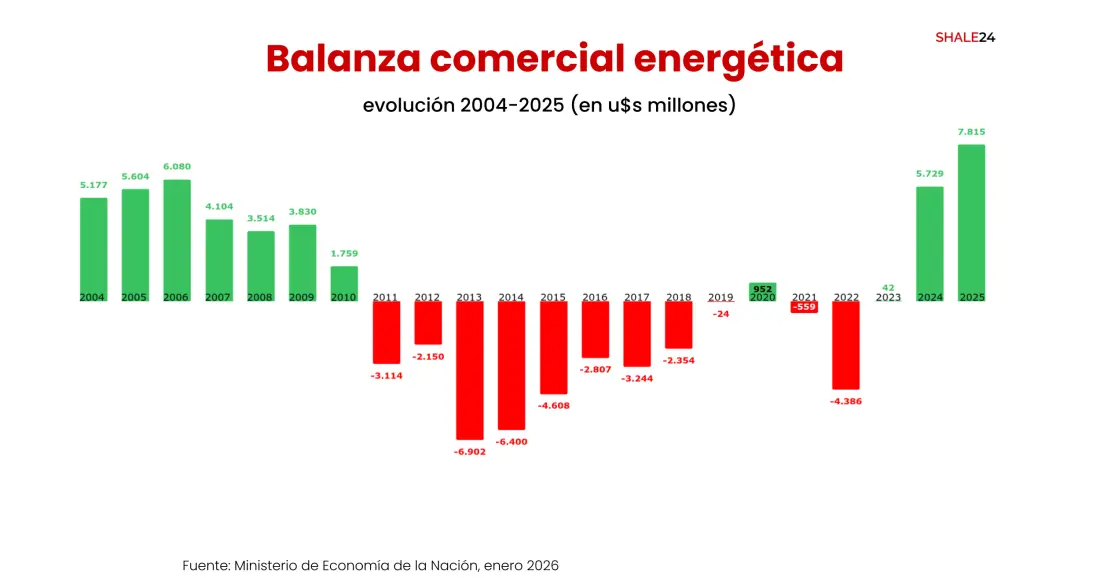

Data released by the Ministry of Economy shows the country is consolidating its position as a net energy exporter, with metrics surpassing historical records from the past 25 years.

The undisputed driver of this shift is the Vaca Muerta formation — one of the world’s largest shale plays, located in Argentina’s Neuquén Basin — whose operational efficiency pushed oil production to nearly 861,000 barrels per day at the close of the penultimate month of 2025. The figure marks a 12% year-over-year increase and reinforces unconventional output as the pillar supporting more than 65% of national supply.

These numbers have allowed Argentina to surpass Colombia in crude production and now set its sights on competing with Guyana for a top position in South America.

In 2025, the energy trade balance posted a record surplus of $7.815 billion, tripling initial projections and accounting for nearly 70% of Argentina’s total positive foreign trade balance.

Export expansion

This financial result stems from a dual-impact strategy: aggressive export growth — averaging $1.067 billion in December — and a sharp reduction in liquefied natural gas (LNG) imports, enabled by optimized transport infrastructure and the reversal of logistical flows that previously depended on Bolivian supply.

The year 2025 marked the point at which technical deployment in the Neuquén Basin reached industrial maturity levels comparable to top U.S. shale plays. The year closed with a cumulative 23,896 fracturing stages, representing a 34% operational increase from the previous year.

This acceleration in well completions not only ensures the immediate flow of hydrocarbons but also supports critical, continent-scale infrastructure projects such as the Vaca Muerta Sur Pipeline (VMOS), which is already more than 50% physically complete.

From a strategic standpoint, the project is essential because it will eliminate logistical bottlenecks and allow Argentina to pursue the ambitious goal of producing 1 million barrels per day by the end of 2026, positioning the country as a strategic player in the global light crude market.

Gas import substitution

The transformation of Argentina’s energy trade balance was also driven by a steep drop in gas imports — one of the most significant operational and financial efficiency milestones of the past decade.

This shift is no accident but the result of an engineering and business architecture designed to capitalize on Vaca Muerta’s geological abundance through key infrastructure such as the Perito Moreno Gas Pipeline and the recent reversal of the Northern Gas Pipeline.

From a technical perspective, the country successfully replaced gas imported from Bolivia and LNG cargoes — typically traded at volatile international spot prices between $12 and $18 per million British thermal units (MMBtu) — with highly efficient domestic production averaging costs of $3.50 to $4.50 per MMBtu under the Plan Gas.Ar framework.

This structural reduction in costs not only shields the Central Bank’s international reserves by preventing hard-currency outflows but also injects direct competitiveness into Argentina’s broader industrial ecosystem, enabling a more predictable, affordable, and domestically sourced energy supply.

Bullish outlook for 2026 and beyond

By the end of the current operational cycle, technical projections and estimates from private-sector analysts place the energy trade surplus within a consolidated range of $9 billion to $11 billion.

This result will be a direct consequence of midstream projects coming online under the Incentive Regime for Large Investments (RIGI), with the Vaca Muerta Sur Pipeline standing out among them.

With committed investment exceeding $2.5 billion, the infrastructure will enable incremental crude evacuation, pushing national output toward the 1 million barrels-per-day threshold while optimizing logistics costs and maximizing export parity for local operators.

Looking toward 2030, Argentina is preparing for an exponential expansion of its export capacity, with net energy balances projected to reach a record $25 billion to $30 billion annually.

This leap is intrinsically tied to the realization of mega LNG projects that have already begun the process of joining the RIGI framework, including Argentina LNG initiatives developed jointly with Golar LNG.

According to projections from global consultancies such as PwC and strategic analysis by the Argentine Chamber of Hydrocarbon Exploration and Production (CEPH), by the end of the decade the country will have consolidated liquefaction infrastructure capable of processing more than 250 million cubic meters of gas per day, transforming Vaca Muerta’s “stranded” gas into a high-demand global commodity.

This business scenario envisions Argentina integrated into Asian and European markets, capitalizing on a window of opportunity in which natural gas serves as the fuel of choice for the energy transition.

By 2035, the national energy map points to full consolidation, with net foreign-currency inflows — together with the mining sector — expected to reach $75 billion in total exports, of which the energy component would represent a net positive balance exceeding $35 billion.

At that stage, the maturity of unconventional fields will be complemented by mining development, also encouraged by the 30-year stability benefits granted under the RIGI framework.

By the middle of the next decade, Argentina will not only have eliminated any trace of dependence on energy imports but will have established itself as a regional energy hub, supplying Brazil and Chile uninterruptedly through a fully amortized network of gas pipelines and electrical interconnections.

This long-term outlook, grounded in regulatory predictability and geological efficiency, places the country among the top five net energy exporters in the hemisphere.