Merey 16 is Venezuela’s benchmark crude, a heavy and sour oil that accounts for the bulk of exports by state-owned Petróleos de Venezuela S.A. (PDVSA).

Produced mainly in the Orinoco Oil Belt, this grade is obtained by blending extra-heavy crude with lighter diluents, which facilitates transportation and refining. Since its inclusion in the OPEC basket in January 2009, Merey 16 has been an economic pillar for the country, though it faces significant challenges from international sanctions and volatility in global prices.

Its importance lies in its high production volumes and strong demand from refineries specialized in processing heavy crudes, particularly in Asia and parts of the Americas. This technical overview details its specifications, production process, history, pricing at the end of 2025, the impact of sanctions, comparisons with other heavy crudes and refining requirements.

Technical specifications

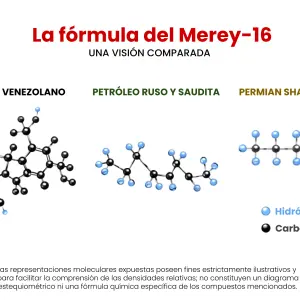

Merey 16 is classified as a heavy, sour crude, with properties that make it suitable for complex refineries equipped with coking and desulfurization units. Its main characteristics include:

- API gravity: Approximately 16 degrees, placing it firmly in the heavy crude category, with heavy crude defined as below 20 degrees API. Typical values range between 15.9 and 16.2 degrees API, with a density of about 1,010 kilograms per cubic meter.

- Sulfur content: High, typically between 2.5% and 3.4% by weight. This classifies it as sour crude, requiring advanced refining processes to remove sulfur and meet environmental standards such as IMO 2020 regulations for marine fuels.

- Viscosity: High, complicating natural flow. At 100 degrees Fahrenheit (37.8 Celsius), it shows elevated kinematic viscosity, requiring diluents for handling.

- Other components: It contains high levels of vanadium, around 300 to 400 parts per million, and nickel, typical of Venezuelan heavy crudes. These metals can damage refinery catalysts if not properly managed. Its pour point is relatively low, around minus 15 degrees Celsius, facilitating transport in colder climates.

- Distillation fractions: It yields a high proportion of heavy residues, more than 50%, suitable for coking, but low volumes of lighter fractions such as naphtha and gasoline.

These properties differentiate it from lighter crudes such as Brent, which has about 38 degrees API and 0.4% sulfur, making Merey 16 less valuable due to higher refining costs.

Production process

Production of Merey 16 is centered in the Orinoco Oil Belt, the world’s largest heavy oil reserve, with an estimated 1.3 trillion barrels recoverable.

The process involves:

- Extraction of extra-heavy crude: The base crude has an API gravity of 8 to 10 degrees and is extracted using methods such as steam-assisted gravity drainage, or SAGD, or horizontal wells with electric submersible pumps. This accounts for roughly 60% of Venezuela’s current production.

- Blending and dilution: To reduce viscosity, the crude is blended at an approximate 60/40 ratio with lighter crudes such as Mesa, around 30 degrees API, or imported condensates. PDVSA uses blendstocks such as naphtha or condensate to achieve the 16 degrees API specification. This step is carried out at terminals such as Jose, from which most exports are shipped.

- Operational challenges: Production requires diluents that are in short supply domestically, leading to reliance on imports constrained by sanctions. In 2025, Venezuelan output averaged about 800,000 to 900,000 barrels per day, with sharp declines in December due to logistical restrictions.

Production has fallen from peaks of about 3 million barrels per day in the 2000s due to underinvestment and sanctions, though it showed tentative recovery through late 2025.

History as a benchmark crude

Merey 16 emerged in the 2000s as a standardized export blend, replacing grades such as Zuata. In 2009, it was incorporated into the OPEC basket, reflecting Venezuela’s transition toward heavier crudes. Historically, Venezuela produced lighter oils, averaging about 22 degrees API, but depletion of conventional fields drove a strategic focus on the Orinoco.

In 2021, S&P Global Platts launched a daily price assessment for Merey 16, improving market transparency. Its strategic role grew through partnerships such as those with China, which financed projects in exchange for crude supply.

By late 2025, Merey 16 came under strong downward pressure due to tighter U.S. sanctions, competition from sanctioned Russian and Iranian crudes, and global oversupply. In November 2025, the OPEC basket, which includes Merey, averaged $64.46 a barrel, while in December it fell to $61.78 a barrel.

However, Merey traded at wider discounts. In early December, discounts were about $14 to $15 a barrel below Brent, widening to as much as $21 a barrel by mid-December. This placed effective prices in Asian transactions at roughly $40 to $47 a barrel, with Brent closing the year at about $60.75 to $60.85 a barrel.

The wider discounts reflected logistical risks, a buildup of more than 11 million barrels in offshore inventories and partial halts in exports.

Impact of U.S. sanctions

U.S. sanctions, intensified since 2019 and dramatically reinforced in December 2025 with tanker seizures, naval blockades and additional designations, cut Merey 16 exports by more than 50% in the final month of the year. This led to inventory accumulation, halted cargoes and estimated losses in oil revenue. In December 2025, production fell to lows, with exports disrupted by so-called ghost fleets and operational damage, forcing Venezuela to rely on a limited group of allies and worsening domestic challenges.

Comparison with other heavy crudes

Merey 16 is often compared with grades such as Maya from Mexico and Western Canadian Select, or WCS, from Canada.

- Merey 16 vs. Maya: Maya has an API gravity of about 21 to 22 degrees and sulfur content of around 3.3%, making it slightly lighter and less viscous. Price differentials are similar, but Maya does not face comparable sanctions.

- Merey 16 vs. WCS: WCS has an API gravity of about 21.4 degrees and sulfur content near 3.6%, making it comparable in quality but with better access to markets.

These crudes compete in high-complexity refineries, where price differentials are shaped by geopolitical risk.

Refining process and suitable refineries

Merey 16 requires complex refineries, with a Nelson complexity index above 10, equipped with coking units to process heavy residues and hydrocracking units to handle sulfur. The refining process includes distillation, coking and desulfurization.

Suitable refineries include large complexes in China, India and the United States, particularly along the U.S. Gulf Coast, which have historically been configured to run Venezuelan crude. Sanctions, however, have sharply limited access to these outlets.

Merey 16 crude: From the Orinoco Belt to the OPEC basket – The story of the crude that defines Venezuela

In the global oil world, Venezuela is no longer just “the country with the world’s largest reserves.” It’s increasingly the country of Merey 16, the heavy, sour crude now trading at massive discounts to Brent and carrying much of the nation’s economy on its back. But where does this almost tropical-sounding name come from, and why has it become Venezuela’s official export marker?

The Merey story doesn’t start in the giant Orinoco Belt fields—it goes back to the 1950s, when Venezuelan oil was still mostly light and sweet, and the world guzzled it eagerly. It begins with the Merey Block, operated by Mene Grande Oil Company (later absorbed by Gulf Oil, and eventually Chevron). There they produced an extra-heavy crude of 10–11° API—so viscous it needed blending downhole with a 21.4° API lighter stream just to flow. The resulting mix hit around 15° API, and for commercial convenience, they called it “Merey.”

The name stuck, even though today’s blend no longer comes strictly from that original block. Through the 1980s and 1990s, Venezuela exported mainly medium and light crudes (Zuata, BCF-17, etc.). But as conventional fields depleted and the massive Orinoco Belt reserves—over 1.3 trillion barrels recoverable of 8–10° API extra-heavy—came online, everything changed.

In the 2000s, strategic associations (Petrozuata, Cerro Negro, Sincor, Hamaca) saw PDVSA and international partners dilute the extra-heavy with naphtha or light condensates to make it pumpable and marketable.

The standardized blend—roughly 60% extra-heavy + 40% 30° API diluent—became Merey 16 (16° API, ~2.4–2.7% sulfur). In 2009, it officially joined the OPEC basket, replacing the old BCF-17 as Venezuela’s marker. It was official: Venezuela had become a heavy-crude nation.

Since then, Merey has been the barometer of Venezuela’s crisis. Production collapsed from over 3 million bpd in 1998 to under 900,000 bpd in 2025 due to underinvestment, sanctions, diluent shortages, and PDVSA mismanagement.

Today, Merey trades at brutal discounts: late 2025 saw peaks of -$21/bbl vs. Brent, and in early January 2026, offers ranged from -$13 to -$22 depending on cargo, destination, and geopolitics (China and India take most, with recent U.S. talks resuming flows under new political shifts).

Key Merey stats today (January 2026):

- API gravity: 15–16° (heavy and sour).

- Sulfur: ~2.5%.

- 2025 average price: ~$58–65/bbl (vs. Brent ~$75–80 earlier; recent Brent around $59–60).

- Main export destinations: Asia (India’s Reliance reopening doors under new U.S. oversight; China still dominant but shunning some offers).

- Challenges: Expensive imported diluents, intermittent sanctions/blockades, Jose terminal logistics, and cyber/operational risks.

At its core, Merey symbolizes a failed transition. Venezuela had the technology (upgraders like Petropiar and Petromonagas), international partners, and reserves to dominate heavy crude. But the 2007 expropriations, PDVSA politicization, and sanctions since 2017 turned black gold into a financial drag. As the world debates the energy transition, Merey keeps trickling out of the Orinoco to Asian and Gulf Coast refineries that need it to grease their margins. Its story isn’t over—it’s just on a new chapter.

One of the leading processors of heavy crude oil in the United States

Citgo Petroleum Corp., one of the leading processors of heavy crude oil in the United States, is facing a critical moment following the U.S. attack on Venezuela that ended with the capture of former President Nicolás Maduro.

With refining capacity of about 749,000 barrels per day across three complexes in Lake Charles, Louisiana; Corpus Christi, Texas; and Lemont, Illinois, Citgo has historically been the main channel for processing extra-heavy crude from Venezuela’s Orinoco oil belt.

As noted, the refiner currently operates as Citgo Petroleum Corp. However, the key point is that historically, since 1990, Citgo has been wholly owned by PDV Holding Inc., a subsidiary of Venezuela’s state-owned oil company PDVSA.

U.S. sanctions imposed in 2019, combined with a lengthy legal process linked to Venezuela’s debts and expropriations, have left PDVSA without control of or economic benefit from Citgo since that time.

In December 2025, a federal judge in Delaware approved the sale of PDV Holding’s shares, Citgo’s parent company, to Amber Energy, a subsidiary of hedge fund Elliott Investment Management, for about $5.9 billion.

The sale is intended to satisfy creditor claims totaling more than $20 billion.

In practice, the transaction has been approved but has not yet fully closed. It is expected to be completed in 2026, pending regulatory approvals, including authorization from the U.S. Treasury Department’s Office of Foreign Assets Control, and potential appeals.