Merey 16 is the flagship product of Venezuela’s Orinoco Oil Belt. Technically, it is defined as a heavy crude, with an API gravity of around 16 degrees and a substantial sulfur content, roughly between 2.5% and 3.4%.

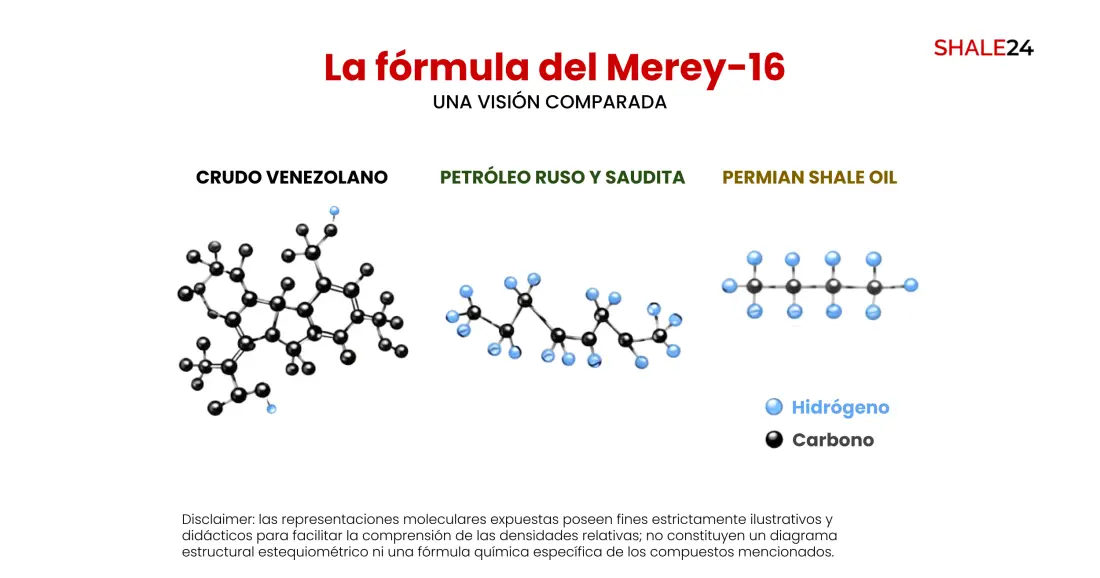

Its molecular structure consists of a complex architecture of long-chain hydrocarbons and dense aromatic rings. When different crude types are compared, a common misconception sometimes arises that one type of oil is inherently “better” than another. From a process engineering and asset-optimization perspective, however, the reality is very different.

Engineers generally do not speak in terms of absolute quality but rather of technical specificity. In this context, Merey 16 is a crude that requires a certain level of technological development in refining. Due to its high viscosity and density, it cannot be processed at just any refinery.

It requires high-complexity refineries, with elevated Nelson complexity indices, equipped with coking units and hydrocracking processes. These plants are designed to break down those molecules, converting heavy residues into higher-value products.

What would be unusable residue for a simple refinery becomes, in a complex plant fed with Merey 16, the main input for producing asphalt for high-speed highways and heavy marine fuels that meet international regulations.

The global market and blending strategy

From a business standpoint, the real value lies in blending. The world’s most advanced refineries, particularly those located along the Gulf of Mexico, were designed to process a mixed slate of crudes.

Merey 16 is typically in demand for the production of asphalt, heavy fuel oil and petroleum coke, all essential for construction and industrial power generation. The tradeoff is that heavy crude usually trades at a market discount because of its higher processing costs.

By contrast, shale oil from Argentina’s Vaca Muerta formation is characterized as a light, “sweet” crude, with API gravity above 40 degrees and very low sulfur content. These differences with Merey 16 do not make the two grades competitors, as their processing requirements and end uses are very different.

Merey 16: commercialization resumes

The United States has officially begun the commercialization and sale of Venezuelan oil, with a primary focus on the flagship Merey 16 crude, completing initial transactions valued at about $500 million.

These operations are part of a broader agreement of up to $2 billion negotiated between Washington and the interim government in Caracas, following recent geopolitical events that included the capture of Nicolás Maduro and U.S. control over Venezuelan oil exports.

Merey 16, Venezuela’s characteristic heavy blend, with roughly 16 degrees API and high sulfur content, was offered this week to U.S. Gulf Coast refineries at a discount of about $6 a barrel to Brent futures. That pricing makes it more competitive than direct peers such as Western Canadian Select, which traded at a discount of about $12.50 to Brent.

As a result, Merey 16 is trading at a relative premium for U.S. refineries specialized in heavy, sour crudes, which view the Venezuelan grade as attractive due to its geographic proximity and technical characteristics.

Initial sales involve significant volumes within an authorized export framework of 30 million to 50 million barrels of Venezuelan crude to the United States, in cooperation with U.S. companies and international traders.

Firms such as Vitol and Trafigura have been designated to market and transport the oil, receiving initial cargoes of Merey 16—about 2.5 million barrels for Vitol and roughly 2.33 million for Trafigura—bound for Caribbean storage hubs such as Curacao and the Bahamas before final delivery.

Proceeds from these initial sales, the roughly $500 million cited, are being held in bank accounts overseen by U.S. authorities, with mechanisms in place to distribute benefits among Venezuelan parties, U.S. companies and the federal government. Funds allocated to Venezuela are restricted exclusively to the purchase of U.S.-manufactured products, in line with the terms of the agreement.

The development marks a sharp shift in Venezuelan export flows, which had previously been directed largely to China and other Asian markets under sanctions. Now, Merey 16 is being redirected in a controlled manner to the U.S. market, benefiting Gulf Coast refineries and potentially reducing reliance on Canadian heavy crude or other sources. More transactions are expected in the coming days and weeks, a trend that could cement Merey 16 as a key component of the Western Hemisphere heavy crude balance in 2026.